The straight-line depreciation method differs from other methods because it assumes an asset will lose the same amount of value each year. With these numbers on hand, you’ll be able to use the straight-line depreciation formula to determine the amount of depreciation for an asset on an annual or [review] xero monthly basis. At this point, the company has all the information it needs to calculate each year’s depreciation. It equals total depreciation ($45,000) divided by the useful life (15 years), or $3,000 per year. The IRS provides guidelines on appropriate useful lives for various asset classes.

The Importance of Depreciation in Accounting

GAAP guidelines highlight several separate, allowable methods of depreciation that accounting professionals may use. Accelerated depreciation methods, like the declining balance approach, allocate a larger portion of an asset’s cost to depreciation expense in the earlier years of its useful life. This approach often aligns more closely with the actual depreciation pattern of many assets, especially technology and vehicles. As depreciation expense is recorded over an asset’s useful life, the balance in the accumulated depreciation account increases.

Excel Depreciation Waterfall Schedule Calculation

But in the absence of such data, the number of assumptions required based on approximations rather than internal company information makes the method ultimately less credible. Alternatively, you wouldn’t depreciate inexpensive items that are only useful in the short term. We believe everyone should be able to make financial decisions with confidence.

Advantages of the SYD Method

- Income statement accounts are referred to as temporary accounts since their account balances are closed to a stockholders’ equity account after the annual income statement is prepared.

- Although depreciation reduces net income, it does not directly impact cash flow.

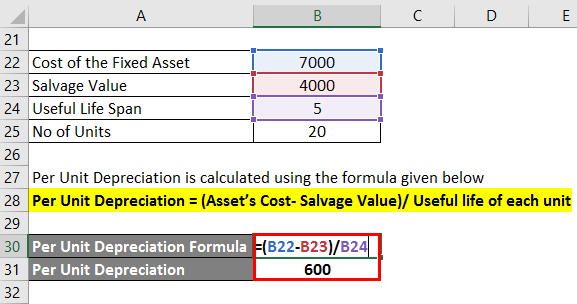

- The four depreciation methods include straight-line, declining balance, sum-of-the-years’ digits, and units of production.

- The depreciation expense can be projected by building a PP&E roll-forward schedule based on the company’s existing PP&E and incremental PP&E purchases.

Since the balance is closed at the end of each accounting year, the account Depreciation Expense will begin the next accounting year with a balance of $0. To make the topic of Depreciation even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our depreciation cheat sheet, flashcards, quick tests, business forms, and more. For sure, one of the most interesting cases of depreciation is the loss of value of a motor vehicle. Over the next years, the value of the car decreases, until after several years (around 10 to 11), it reaches zero value. To avoid the hassles of selling a used car, many people prefer leasing a car these days instead of buying one.

Calculating depreciation expense is an important aspect of financial management for business owners. By understanding and applying various methods such as straight-line, declining balance, and units of production, you can accurately allocate the cost of your assets over their useful lives. Typical indirect methods include straight line, declining method, units of production depreciation, and sum-of-the-year depreciation. With the double-declining balance method, higher depreciation is posted at the beginning of the useful life of the asset, with lower depreciation expenses coming later. This method is an accelerated depreciation method because more expenses are posted in an asset’s early years, with fewer expenses being posted in later years.

By recording depreciation, companies show how assets decline in value over time on their financial statements. By calculating depreciation expense using this straightforward formula, a business can systematically allocate the cost of a fixed asset over its useful lifespan. This allows the business to match expenses to revenue for more accurate financial reporting. Businesses use accelerated methods when dealing with assets that are more productive in their early years. The double declining balance method is often used for equipment when the units of production method is not used.

If you are a business owner, executive manager, or entrepreneur, you must understand what the depreciable cost is to account for business expenses correctly, timely, and compliantly. After using the straight-line depreciation method, the IRS allows businesses to use the straight-line method to write off certain business expenses under the Modified Accelerated Cost Recovery System (MACRS). Having a solid grasp of depreciation principles and calculations is critical for accurate financial reporting and optimal tax strategy.

It’s most useful where an asset’s value lies in the number of units it produces or in how much it’s used, rather than in its lifespan. The formula determines the expense for the accounting period multiplied by the number of units produced. The straight-line method is the most straightforward and widely used approach to calculating depreciation expense. Its simplicity makes it an excellent choice for business owners who want a clear, consistent way to account for asset depreciation over time. Understanding how to compute depreciation empowers business owners to choose the most appropriate method for their specific needs. This knowledge equips entrepreneurs with essential tools to confidently calculate depreciation expenses and gain a clearer picture of their company’s financial health.

For purposes of the units of production method, shown last here, the company’s estimate for units to be produced over the asset’s lifespan is 30,000 and actual units produced in year one equals 5,000. You can use this method to anticipate the cost and value of assets like land, vehicles and machinery. While the upfront cost of these items can be shocking, calculating depreciation can actually save you money, thanks to IRS tax guidelines. The depreciated cost method of asset valuation is an accounting method used by businesses and individuals to determine the useful value of an asset. It’s important to note that the depreciated cost is not the same as the market value. The market value is the price of an asset, based on supply and demand in the market.

Leave A Reply (No comments So Far)

No comments yet