It does not matter if the trailer could be sold for $80,000 or $65,000 at this point; on the balance sheet, it is worth $73,000. This formula is best for production-focused businesses with asset output that fluctuates due to demand. This formula is best for companies with assets that lose greater value in the early years and that want larger depreciation deductions sooner. So, the company should charge $2,700 to profit and loss statements and reduce asset value from $2,700 every year.

Introduction to Depreciation Expense in Accounting

Recording the paired debit and credit entries shows the expense while also tracking the asset’s declining book value. From an accounting perspective, depreciation is the process of converting fixed assets into expenses. Also, depreciation is the systematic allocation of the cost of noncurrent, nonmonetary, tangible assets (except for land) over their estimated useful life. If an asset is depreciated for financial reporting purposes, it’s considered a non-cash charge because it doesn’t represent an actual cash outflow. While the entire cash outlay might be paid initially—at the time an asset is purchased—the expense is recorded incrementally (to reflect that an asset provides a benefit to a company over an extended period of time). And, the depreciation charges still reduce a company’s earnings, which is helpful for tax purposes.

- However, it is logical to report $10,000 of expense in each of the 7 years that the truck is expected to be used.

- Obviously, in real life, it is impossible to accurately predict the exact salvage value of an asset after a particular number of years.

- Or, it may be larger in earlier years and decline annually over the life of the asset.

- To demonstrate this, let’s assume that a retailer purchases a $70,000 truck on the first day of the current year, but the truck is expected to be used for seven years.

- The difference between the debit balance in the asset account Truck and credit balance in Accumulated Depreciation – Truck is known as the truck’s book value or carrying value.

How Depreciation Works in Accounting

The various methods used to calculate depreciation include straight line, declining balance, sum-of-the-years’ digits, and units of production, as explained below. Depreciation expense is recorded in accounting by making a debit to depreciation expense on the income statement and a credit to accumulated depreciation on the balance sheet. Understanding depreciation is crucial for any business that uses long-term assets like property, equipment, or vehicles to generate revenue.

Double declining balance depreciation

Companies seldom report depreciation as a separate expense on their income statement. Thus, the cash flow statement (CFS) or footnotes section are recommended financial filings to obtain the precise value of a company’s depreciation expense. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (PP&E) over its estimated useful life.

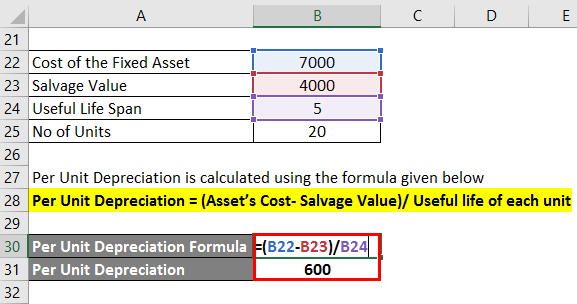

When to Use the Units of Production Method

Annual depreciation is derived using the total of the number of years of the asset’s useful life. The SYD depreciation equation is more appropriate than the straight-line calculation if an asset loses value more quickly, or has a greater production capacity, during its earlier years. For smaller businesses or those who prefer a more hands-on approach, spreadsheet templates can be an effective tool for depreciation calculations. The SYD approach provides a nuanced way to match depreciation expenses with the asset’s value decline, potentially offering both financial reporting accuracy and tax advantages for your business. The declining balance method calculates depreciation as a percentage of the asset’s book value at the beginning of each year.

Suppose, however, that the company had been using an accelerated depreciation method, such as double-declining balance depreciation. The above example uses the straight-line method of depreciation and not an accelerated depreciation method, which records a larger depreciation expense during the earlier years and a smaller expense in later years. The four depreciation methods include straight-line, declining balance, sum-of-the-years’ digits, and units of production. Depreciation recapture is a provision of the tax law that requires businesses or individuals that make a profit in selling an asset—that was previously depreciated—to report it as income. In effect, the amount of money they claimed in depreciation is subtracted from the cost basis they use to determine their gain in the transaction.

This gradually reduces the net book value of the fixed asset on the balance sheet. The declining net book value reflects the wearing out of the asset over time. Depreciation expense is an important concept in accounting that refers to the systematic allocation of the cost of a fixed asset over its estimated useful life. Calculating depreciation allows businesses to match the expense of using up fixed assets to the revenue those assets generate each year. Depreciation expense is considered a non-cash expense because it does not involve a cash transaction. Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations.

Depreciation accounts for decreases in the value of a company’s assets over time. In the United States, accountants must adhere to generally accepted accounting principles (GAAP) in understanding online payroll calculating and reporting depreciation on financial statements. GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting.

Leave A Reply (No comments So Far)

No comments yet