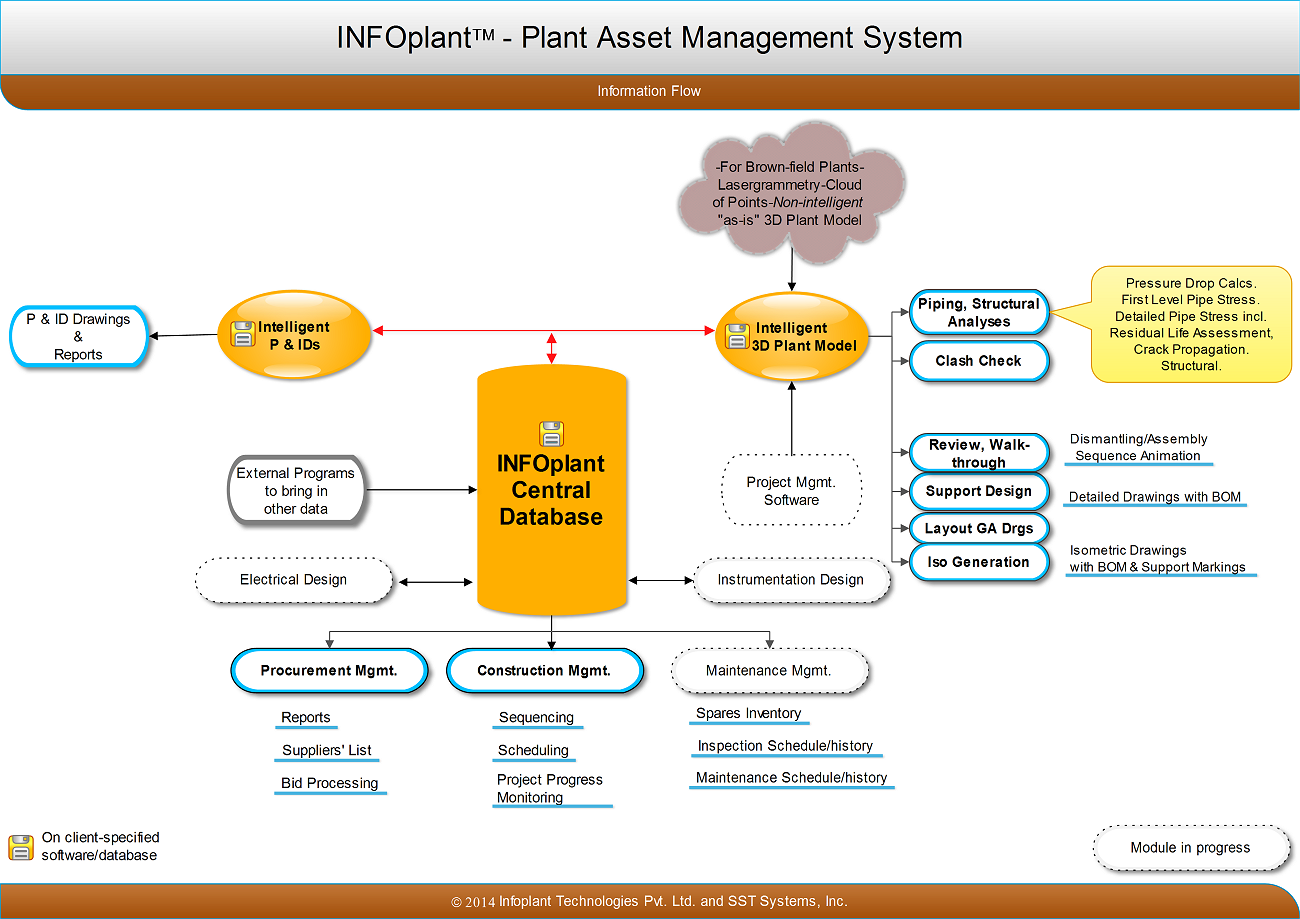

In that case, the estimated realized value of the asset is less than the actual depreciated cost appearing in the books. Property, plant, and equipment (fixed assets or operating assets) compose more than one-half of total assets in many corporations. These resources are necessary for the companies to operate and ultimately make a profit. It is the efficient use of these resources that in many cases determines the amount of profit corporations will earn. plant asset management software is a crucial tool for organizations looking to optimize their asset performance, reduce downtime, and improve overall operational efficiency. These specialized systems help companies track, maintain, and manage their physical assets throughout their lifecycle, from acquisition to disposal.

What are Plant Assets? Definition, Examples, Management

Usually this cost includes architect’s fees; building permits; payments to contractors; and the cost of digging the foundation. Also included are labor and materials to build the building; salaries of officers supervising the construction; and insurance, taxes, and interest during the construction period. Any miscellaneous amounts earned from the building during construction reduce the cost of the building. It’s important to note that the value of plant assets (other than land) depreciates over time, and each type of asset has a specific “useful life” that is defined by the IRS. This method implies charging the depreciation expense of an asset to a fraction in different accounting periods. This method explains that the utility and level of economic benefit decrease as the age of asset increases.

- There are different ways through which a company can provide for reducing the cost of the asset.

- Plant assets must also be reviewed for impairment at regular intervals.

- Current assets include items such as cash, accounts receivable, and inventory.

- Let’s take another look at The Home Depot, Inc. balance sheet as of February 2, 2020.

Straight Line Method

Proper asset identification, using methods such as asset tags or labels, is crucial for maintaining accurate records and facilitating efficient maintenance schedules. This specialized approach is essential for operations with significant capital investments, as it can dramatically reduce costs, improve productivity, and extend the lifespan of crucial assets. By implementing a comprehensive plant asset management system, companies can optimize their maintenance schedules, reduce downtime, and make data-driven decisions about asset replacement and upgrades. Depreciation is the periodic allocation of an asset’s value(cost) over its useful life. The basic principle working behind the depreciation of assets is the matching principle. The matching principle states that expenses should be recorded in the same financial year when the revenue was generated against them.

Building

Current assets include items such as cash, accounts receivable, and inventory. Property, plant, and equipment – which may also be called fixed assets – encompass land, buildings, and machinery including vehicles. On a business’s balance sheet, capital assets are represented by the property, plant, and equipment (PP&E) figure. Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash. Purchases of PP&E are a signal that management has faith in the long-term outlook and profitability of its company. Companies that are expanding may decide to purchase fixed assets to invest in the long-term future of the company.

Depending on the industry, plant assets may make up either a very substantial percentage of total assets, or they may make up only a small part. Industries like heavy shipping or oil extraction stand to employ a greater percentage of plant assets than industries like software, in which teams may be remote and sometimes globally distributed. Let us try to understand the difference between plant assets characteristics and current assets. Thus, for plant assets accounting, it is necessary to understand and have a clear idea about the above types of assets.

The total amount allocated to depreciation expense over time is called accumulated depreciation. Land assets are not depreciated because of their potential to appreciate and are always represented at their current market value. They carry a monetary value used to earn revenue and profit for the enterprise. They are usually land and building, plant and machinery that may be fixed or movable, or any other equipment that can be categorized as the same. They are recorded at cost and are depreciated over the estimated useful life, or the actual useful life, whichever is lower. Plant assets are different from other non-current assets due to tangibility and prolonged economic benefits.

In loose terms, the difference between the salvage value and the actual cost of the asset is known as depreciation. There are different ways through which a company can provide for reducing the cost of the asset. If required, the business or the asset owner has to book the impairment loss. Enter your information and get a free checklist of the top questions to answer and tips to plan a successful asset tagging project for any asset management or tracking system implementation. Despite the fact that upgrades might be costly, they are nevertheless regarded an asset to a company since they constitute an additional investment in ensuring the company’s success.

These purchases are called capital expenditures and significantly impact the financial position of a company. Noncurrent assets include intangible assets, such as patents and copyrights. They provide value to a company but cannot be readily converted to cash within a year.

The same process will be repeated every year at the end of the financial year. Each asset serves a certain purpose in how it helps a business, and it is more advantageous to focus on their functions rather than their relative worth as long as they serve entities well. Plant assets must also be reviewed for impairment at regular intervals. This classification is rarely used, having been superseded by such other asset classifications as Buildings and Equipment. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

The presentation may pair the line item with accumulated depreciation, which offsets the reported amount of the asset. The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. A capital asset is generally owned for its role in contributing to the business’s ability to generate profit.

Leave A Reply (No comments So Far)

No comments yet